Capt. Runa Jörgens

Head of Issues and Projects/Shipping

Phone: +49 40 9999 698 - 71

E-Mail: Joergens[at]dmz-maritim.de

When trade barriers impede the exchange of goods and services or state intervention favours or discriminates against actors in a one-sided way, this distorts competition. The German Maritime Centre is committed to creating uniform conditions to further strengthen Germany’s competitiveness as a business location.

In the EU member states, including Germany, import VAT is levied on the import of goods from third countries. In Germany, the collection of import VAT is undertaken by the customs administration, while the offsetting of import VAT as input tax is done by the tax authorities of the German states.

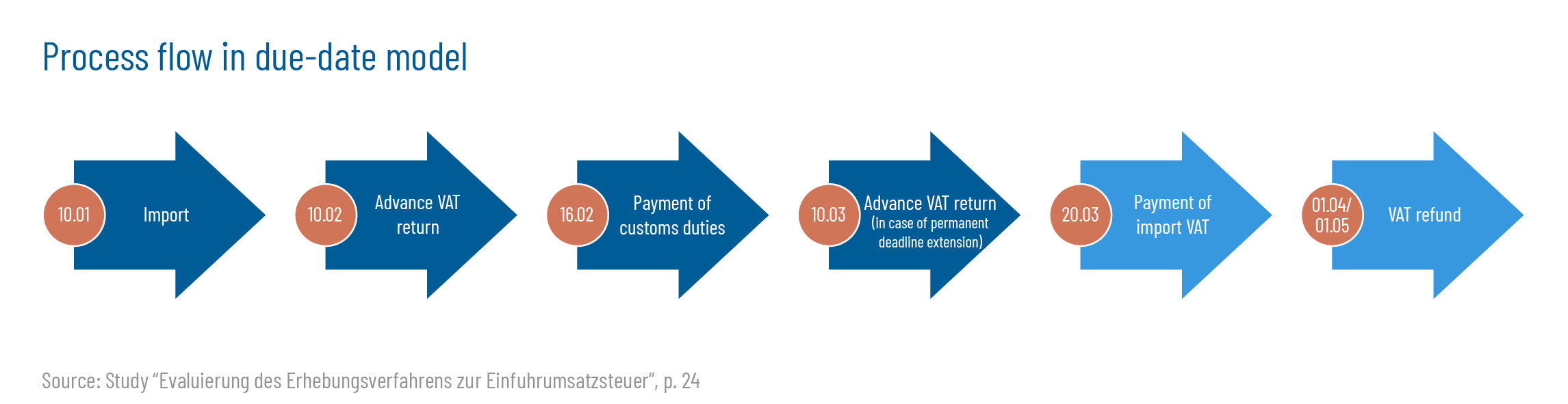

Across European states, collection procedures differ. In the case of Germany, the federal government and the German states decided in June 2020 to introduce the due-date model for the collection of import VAT. They want to compensate for Germany’s competitive disadvantages vis-à-vis its European neighbours. The procedure has been in force since 1 December 2020 and is set to be evaluated by the Federal Ministry of Finance in 2023.

In spring 2021, the German Maritime Centre commissioned the Hanseatic Transport Consultancy Dr. Ninnenmann & Dr. Rössler GbR and AWB Rechtsanwaltsgesellschaft mbh to conduct a study and provide expert advice on the introduction of the new collection procedure. The study was intended to create a sound basis (for the responsible administration) to make decisions on the possible introduction of an offsetting model.

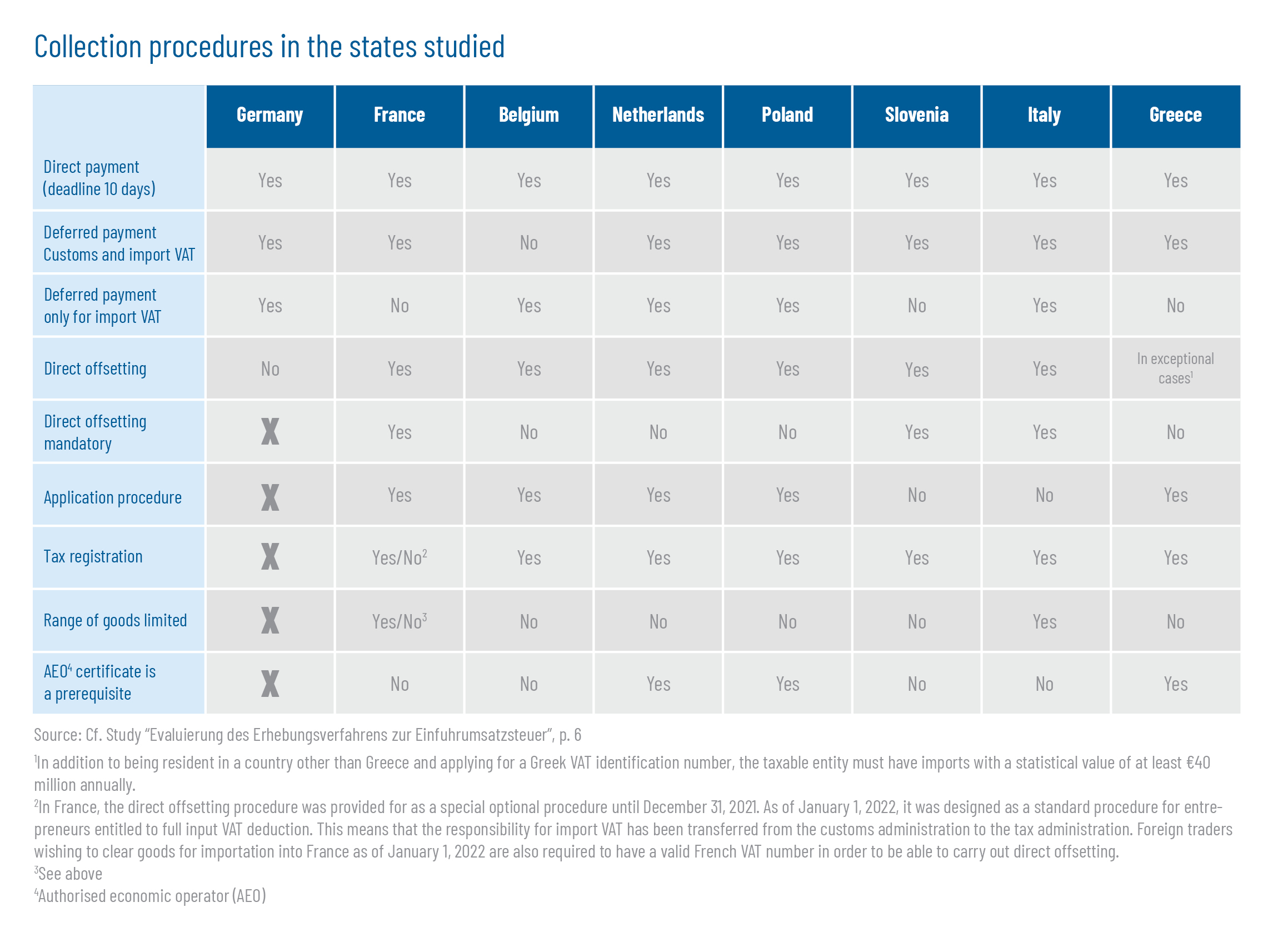

It examines the different procedures for collecting import VAT in EU member states where imports via seaports play a significant role. Besides those in Germany, these are the collection procedures in Belgium, France, Slovenia, Poland, Italy, Greece and the Netherlands.

The study concludes that, unlike Germany, the member states examined make use of the option under the European VAT system directive to simplify the collection procedure for import VAT. For this purpose, the member states have introduced regulations for offsetting import VAT and input tax into national law. However, the individual national procedures are designed differently.

The due-date model introduced by the federal and state governments in Germany cannot compensate for Germany’s competitive disadvantage vis-à-vis its European neighbours; the study did not find an increase in third-country imports. Despite the postponed payment due date, the due-date model (and accordingly the postponement of the date on which taxes must be paid) continues to tie up capital for importers.

This tying up of capital/liquidity is not, strictly speaking, necessary. The European VAT system directive allows EU member states to delay payment of import VAT until traders make their VAT declaration. This means that the payment is not made at the time of importation; that is, it is not required when the goods enter the European Union market. This offsetting in the VAT declaration preserves the taxpayer’s liquidity. Traders would not have to pay the VAT to the customs administration but would offset it as part of their regular advance VAT declaration.

This so-called offsetting model, made possible by the EU directive, is already applied by the majority of EU member states. This gives them a competitive advantage over Germany as a logistics location.

In order to compensate for Germany’s competitive disadvantages, especially compared to its neighbours, the authors of the study make the following recommendations for action, among others:

- Make use of the EU framework and push ahead with the introduction of a collection procedure based on offsetting in advance VAT declarations.

- Draw on the experience of neighbouring European countries (the collection procedures used in France, Belgium and the Netherlands provide a possible example).

- Develop and implement a German model of direct offsetting of import VAT.

- Actively support the changeover process and provide guidance via communication and education strategies

- In the transition phase: Simplify the conditions for and access to the due-date model; lower the hurdles for deferral accounts and make them available to everyone; actively promote the use of deferral accounts.

The German Maritime Centre will continue to monitor the issue and eagerly awaits the evaluation by the Federal Ministry of Finance.

The complete study is available only in German.